Highlights:

- Financial institutions are recognizing the evolving demands of customers in the digital age, where personalized experiences, seamless interactions, and on-demand solutions are the norm. According to a PwC report, 68% of financial services executives believe that improving the customer experience is a top priority for their organization.

- Traditional financial institutions are faced with legacy infrastructure and processes, making it challenging to adapt quickly. The cloud emerges as a transformative force to bridge this gap

- Real-life examples like JPMorgan Chase, Capital One, DBS Bank, Wells Fargo, and Citigroup showcase how cloud technology has empowered financial institutions to enhance customer experiences, offer personalized services, and stay competitive in the digital era.

- Microsoft Azure, in tandem with Data Dynamics, is spearheading this transformative journey

In this Quick Byte:

In the ever-evolving landscape of financial services, the adage “customer is king” has never held more truth. Today’s customers are not merely seeking transactions; they are seeking tailored experiences, seamless interactions, and personalized solutions. The rise of fintech disruptors has highlighted the importance of understanding and adapting to these shifting customer preferences with remarkable agility.

In this era, where financial institutions are confronted with a demanding and dynamic clientele, the cloud emerges as a transformative force—a bridge between the traditional ways of banking and the heightened expectations of the modern customer. The financial industry finds itself at a crossroads, where innovation is no longer an option but an imperative.

This blog will explore how financial institutions are harnessing the power of the cloud to embark on a journey toward a customer-centric culture. It will delve into the technologies, strategies, and real-world examples that are reshaping the financial landscape, offering customers not just what they want but what they need in ways they’ve never imagined. So, fasten your seatbelts as we embark on this journey into the future of finance, where the cloud is the compass guiding institutions toward a more customer-centric horizon.

Customer Evolution: Shaping the Cloud-Driven Future of Finance

To truly appreciate the significance of the cloud in creating a customer-centric culture within financial institutions, we must first understand the evolution of customers themselves. Not too long ago, the banking experience was defined by physical branches, paper transactions, and limited accessibility. Customers were largely passive recipients of services, often resigned to long queues and rigid banking hours.

However, the digital age has ushered in a profound transformation. Customers today are digital natives accustomed to instant gratification and on-demand services. They carry the world of finance in their pockets, with smartphones serving as portals to a universe of financial possibilities. The expectation of convenience, real-time access, and personalized experiences has become the norm. In today’s landscape, customers demand more than just financial services. They want a seamless blend of technology and human touch. They expect:

- Hyper-Personalization:

In today’s banking landscape, customers aren’t just seeking financial solutions; they crave experiences that truly resonate with their unique life journeys. In a survey by Accenture, 91% of consumers said they are more likely to trust brands that provide relevant offers and recommendations. Forward-thinking banks are utilizing AI-driven insights to craft personalized financial pathways that anticipate customers’ needs, recommending not just savings or investments, but financial adventures aligned with their aspirations and ambitions.

- 24/7 Financial Universe:

The modern customer doesn’t wait for banking hours. They inhabit a financial universe that never sleeps. According to a report by Fiserv, 82% of consumers expect access to financial services beyond traditional banking hours. Banks of the future are crafting ecosystems where financial services are accessible anytime, anywhere. Whether it’s checking account balances at 2 AM or making international transactions on a Sunday morning, customers demand a financial universe that orbits around them.

- Fortified Data Guardians:

The IBM Security Cost of a Data Breach Report found that the average cost of a data breach in 2022 was $4.35 million. With cyber threats on the rise, the custodians of financial institutions have evolved into formidable data guardians. Beyond the traditional vaults, they employ cutting-edge encryption, decentralized ledgers, and predictive AI to safeguard financial secrets. Customers now expect banks to be at the vanguard of cybersecurity, always vigilant against even the most elusive digital threats.

- Frictionless Financial Zen:

The age of banking hassle is over. Today’s customers are the champions of convenience. They crave seamless financial zen, where every interaction is smooth, intuitive, and swift. A study by PwC revealed that 73% of consumers consider a good user experience to be a key factor when choosing a bank. Innovative institutions are crafting digital interfaces that don’t just facilitate transactions; they orchestrate financial symphonies, turning complexities into harmonies.

- Personal Data Sovereignty:

Customers are seeking a paradigm shift in data ownership. They want to own their financial data and grant limited, temporary access to banks or other financial institutions for specific purposes. According to a survey conducted by Pew Research Center, 79% of Americans are concerned about the way companies use their personal data. This highlights the growing demand for greater control over personal information. Blockchain and decentralized identity solutions can empower customers to control who accesses their financial information, enhancing data privacy and security.

- Pioneering Partnerships in Finance:

Customers no longer see their banks as mere financial institutions; they envision partners in their financial odyssey. According to a survey by Deloitte, 60% of consumers expect their banks to provide access to third-party financial apps and services. Visionary banks are forging pioneering partnerships that provide customers access to the frontier of financial innovation. It’s not just about cutting-edge tools; it’s about granting customers a ticket to the future of finance, where opportunities abound and financial horizons are boundless.

Fintech companies have been at the forefront of understanding and meeting these evolving customer expectations. Unencumbered by legacy systems and established processes, fintechs have demonstrated a remarkable ability to pivot swiftly in response to customer demands. Their agility has enabled them to redefine the financial landscape. Fintechs leverage the cloud’s scalability, data analytics, and agile development to deliver personalized, accessible, and secure financial experiences. They prioritize user-centric design and seamless API integration, creating interconnected ecosystems that redefine the financial landscape.

Traditional financial institutions, on the other hand, often grapple with legacy infrastructure and processes that hinder their ability to adapt quickly. While these systems have served them well in the past, they have become a double-edged sword in the era of rapidly evolving customer expectations. Legacy systems are typically rigid and difficult to modify, designed for a different era when banking primarily occurred in brick-and-mortar branches. This inflexibility makes it challenging for traditional institutions to pivot and respond swiftly to changing customer demands. Moreover, older systems often struggle to scale efficiently, leading to performance issues during peak demand periods.

Over time, these institutions have accumulated vast stores of customer data, yet this data is often siloed in various systems, making it difficult to gain a holistic view of each customer’s financial behavior and needs. Consequently, maintaining and upgrading these legacy systems becomes prohibitively expensive and time-consuming, leaving fewer resources available for innovation. As a result, a growing disconnect has emerged between what traditional financial institutions currently offer and what customers demand in an age of digital-first, highly personalized, and real-time experiences.

This is where the cloud emerges as a pivotal player in the transformation of traditional financial institutions. By migrating their operations to the cloud, these institutions can shed the limitations of legacy systems, retire costly on-premises hardware, and adopt modern, scalable technologies. Cloud technology empowers institutions with the agility to adapt quickly to changing market dynamics and customer preferences, facilitating experimentation, iteration, and innovation at an unprecedented pace. It also enables advanced data analytics, providing institutions with a comprehensive understanding of their customers by aggregating and analyzing data from various sources.

Moreover, cloud solutions are inherently scalable, ensuring services remain available and responsive, meeting customers’ expectations for accessibility. Enhanced cybersecurity measures offered by cloud providers further bolster security, assuring customers that their financial data is safeguarded. In essence, the cloud is a transformative force that empowers traditional financial institutions to reinvent themselves, bridging the gap between their legacy systems and the dynamic expectations of modern customers. With the cloud as their ally, these institutions can embark on a journey towards fostering a truly customer-centric culture, where innovation, personalization, and agility become the cornerstones of their success.

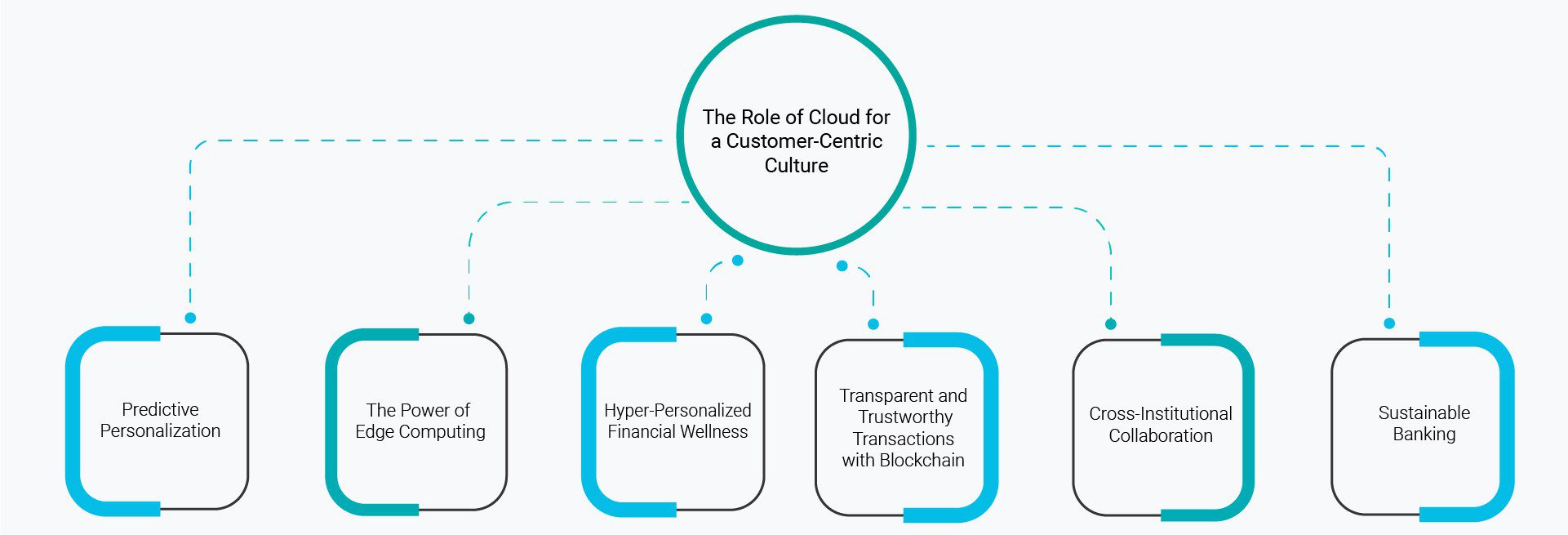

The Role of Cloud for a Customer-Centric Culture: Unlocking Uncharted Potential

The adoption of cloud technology in creating a customer-centric culture at financial institutions is not just about modernization; it’s about a profound shift in how these institutions operate and interact with their customers. Beyond the obvious benefits, there are innovative aspects of the cloud’s role that often go unnoticed but hold immense potential for reshaping the financial industry.

- Predictive Personalization: While personalization is a buzzword in the industry, the cloud takes it to new heights. It’s not just about offering product recommendations based on past behavior; it’s about predicting future needs. Cloud-powered data analytics can sift through vast datasets, identifying subtle patterns and correlations that can anticipate customer requirements even before they express them. This predictive personalization enables financial institutions to proactively offer solutions tailored precisely to each customer’s unique financial journey.

- The Power of Edge Computing: Cloud technology isn’t confined to vast data centers; it extends to the edge of networks, devices, and even physical branches. Edge computing, facilitated by the cloud, allows institutions to process data locally, reducing latency and improving response times. This means that even in remote areas or during network disruptions, customers can access critical services seamlessly. It’s a game-changer for reaching underserved populations and ensuring universal access to financial services.

- Hyper-Personalized Financial Wellness: The cloud’s ability to handle massive data streams can enable the creation of hyper-personalized financial wellness platforms. These platforms not only track spending habits but also incorporate external data sources like news, weather, and economic indicators to provide real-time, context-aware financial advice. Imagine receiving a notification that suggests adjusting your investment portfolio based on a sudden economic development or impending weather-related travel disruptions. The cloud makes this level of real-time, contextual advice a possibility.

- Transparent and Trustworthy Transactions with Blockchain: Cloud-based blockchain solutions provide transparency and security in financial transactions. Blockchain’s immutable ledger, hosted on the cloud, ensures that every transaction is recorded and verifiable. Customers can track their financial activities in real-time, aligning with the need for transparent and trustworthy transactions. Cloud-hosted blockchain networks also facilitate faster cross-border transactions, enhancing customer convenience.

- Cross-Institutional Collaboration: Financial institutions often operate in silos, limiting the scope of services they can provide. However, the cloud enables secure, cross-institutional collaboration through APIs and data sharing. This paves the way for customers to access a broader spectrum of financial services seamlessly. For instance, a customer could initiate a mortgage application with their bank and seamlessly access credit scores or insurance quotes from other institutions, all within a single, unified interface.

- Sustainable Banking: Environmental, social, and governance (ESG) considerations are increasingly crucial in the financial industry. The cloud plays a role here too. By migrating to the cloud, institutions can reduce their carbon footprint by optimizing data center energy consumption and reducing hardware waste. Moreover, the cloud enables data-driven ESG investments, allowing institutions to provide customers with ESG-focused financial products and services aligning with their values.

Here are 5 real-life examples of financial institutions that have leveraged cloud technology to create a more customer-centric culture:

- JPMorgan Chase & Co.: JPMorgan Chase, one of the world’s largest banks, has embraced cloud technology to enhance its customer experience. They have migrated various applications and infrastructure to the cloud, enabling them to scale services efficiently. Their cloud-based data analytics platforms provide deeper insights into customer behavior, enabling more personalized offerings and better fraud detection. This approach has allowed JPMorgan Chase to stay agile and innovative in meeting customer demands and saved $2 billion annually.

- Capital One: Capital One is known for its relentless focus on customer-centricity. They have adopted a cloud-centric approach to banking, migrating a significant portion of their infrastructure to the cloud. Capital One’s cloud-based systems facilitate real-time, personalized recommendations for their customers, such as expense tracking and budgeting insights. This approach has led to a more intuitive and responsive customer experience, reducing customer wait times by 50%.

- DBS Bank: DBS Bank, based in Singapore, has launched “digibank” in India, a mobile-only bank that operates entirely on cloud infrastructure. This innovative approach provides customers with a seamless, mobile-first banking experience. DBS Bank’s cloud-based digital platform allows them to offer personalized financial solutions and real-time transaction notifications, aligning perfectly with modern customer expectations. digibank has grown to over 10 million customers in India in just five years.

- Wells Fargo: Wells Fargo, a prominent U.S. bank, has embraced the cloud to enhance its customer-centric approach. They have migrated critical applications to the cloud, enabling real-time data analysis. This allows Wells Fargo to offer personalized financial advice and recommendations to customers based on their transaction history, helping them make informed financial decisions. Additionally, the cloud-based data analytics platform helped them detect and prevent fraud worth $1.2 billion reinforcing consumer trust and brand equity.

- Citigroup: Citigroup has been actively investing in cloud technology to modernize its operations and improve customer experiences. By leveraging cloud infrastructure, Citigroup can offer secure and scalable digital services. This includes advanced data analytics to identify customer preferences and behaviors, enabling the bank to tailor products and services to individual needs and increasing customer satisfaction by 10%.

Microsoft Azure: Your Partner of Choice

Microsoft Azure provides a robust set of cloud-based services and solutions that can empower financial institutions to create a more customer-centric culture. Here’s how Microsoft Azure can help:

- Scalability and Flexibility: Azure’s cloud infrastructure allows financial institutions to scale their operations quickly and efficiently. Whether it’s handling increased transaction volumes during peak times or expanding services to meet customer demand, Azure provides the flexibility to adapt without major infrastructure investments. This scalability ensures consistent performance and availability, meeting the expectations of today’s always-connected customers.

- Data Analytics and Insights: Azure offers a suite of data analytics tools and services, including Azure Synapse Analytics and Azure Machine Learning. Financial institutions can harness these capabilities to gain deeper insights into customer behavior, preferences, and trends. By analyzing vast datasets, they can provide personalized recommendations, detect fraud in real time, and make data-driven decisions that align with customer expectations.

- Security and Compliance: Security is paramount in the financial industry, and Azure takes it seriously. Microsoft invests heavily in security measures, and Azure offers a robust set of security features, including identity and access management, threat detection, and encryption. Azure’s compliance certifications help financial institutions meet regulatory requirements, assuring customers that their data is secure.

- AI and Machine Learning: Azure provides advanced AI and machine learning services, enabling financial institutions to develop and deploy intelligent applications. These can be used for chatbots, fraud detection, credit scoring, and personalized financial advice. By leveraging Azure’s AI capabilities, institutions can enhance customer engagement and offer tailored solutions based on individual needs.

- API Integration and Ecosystem Building: Azure API Management simplifies the process of building and managing APIs, allowing financial institutions to create interconnected ecosystems. They can collaborate with fintech partners, share data securely, and offer customers a broader range of services through partnerships. This approach facilitates a customer-centric culture by giving customers access to a diverse array of financial services through a single interface.

- Distributed Edge Computing: Azure provides edge computing capabilities, which are crucial for financial institutions aiming to deliver low-latency, real-time services. With Azure IoT Edge and Azure Stack, institutions can process data at the edge of the network, ensuring that customers experience minimal delays in accessing critical services, such as mobile banking or investment trading.

- DevOps and Agile Development: Azure DevOps tools facilitate agile development and continuous integration/continuous delivery (CI/CD) pipelines. This allows financial institutions to innovate rapidly, deploy new features quickly, and respond to changing customer needs. The ability to release updates frequently ensures that customers always have access to the latest enhancements and security patches.

- Hybrid Cloud Solutions: Azure also offers hybrid cloud solutions that enable financial institutions to seamlessly integrate on-premises infrastructure with the cloud. This is particularly valuable for institutions with legacy systems, allowing them to gradually transition to the cloud while preserving existing investments.

The Data Dynamics Advantage

In the pursuit of achieving a customer-centric approach, Microsoft has joined forces with Data Dynamics to introduce the Azure File Migration Program. This groundbreaking partnership is revolutionizing how banks and financial institutions manage the migration of their unstructured files and object storage data to Azure, all while alleviating cost-related concerns. With an automated migration process that prioritizes risk mitigation and maintains strict control over access and file security, the integrity of financial data remains intact. What’s more, these migrations are offered at zero cost, making it an accessible solution for financial institutions aiming to enhance their customer-centric culture.

Data Dynamics’ platform offers a unique set of attributes that set it apart from the rest. It provides an array of features specifically designed to facilitate intelligent data tiering to Azure. Financial institutions can seamlessly migrate individual files, folders, shares, or even entire volumes from their on-premises storage to Azure through automated migration methods. Through policy-based data tiering, institutions can establish rules that automatically relocate data to different storage tiers based on usage patterns. This optimization not only ensures reduced costs but also guarantees that data is placed optimally within the appropriate tier. Addressing data governance, a pivotal concern for the finance sector, Data Dynamics integration with Microsoft Information Protection and Azure Information Protection via Sensitivity Label Management represents a monumental leap in data security and compliance governance during migrations. This potent capability equips organizations to seamlessly identify and manage sensitive data within files located on home shares, SMB shares, and other data repositories. It plays a pivotal role in fortifying sensitive information against potential threats and ensuring adherence to data security, governance, and regulatory mandates.

However, the partnership between Microsoft and Data Dynamics extends beyond data migration; it’s a commitment to invigorating intelligent data management across various environments, including On-Premise, Azure, OneDrive and Hybrid Cloud. By participating in this program, financial institutions gain a distinct advantage in migration projects facilitated by Data Dynamics, ensuring a seamless transition to the Azure platform.

The Azure File Migration Program, born from the collaborative efforts of Microsoft and Data Dynamics, directly addresses the formidable challenges encountered during the intricate cloud migration journey. It tackles issues ranging from cost efficiency and data speed to talent acquisition and risk management. By embracing this program, banks and financial institutions can confidently navigate the intricate nuances of cloud computing, unlocking its transformative potential and bolstering their efforts to become more customer-centric.

To delve deeper into the capabilities of Data Dynamics and the manner in which our platform seamlessly facilitates zero-cost data migration, efficient data management, and cost optimization within Azure, we invite you to explore our website at www.datadynamicsinc.com/microsoft/.

For inquiries, reach out to us at solutions@datdyn.com or connect via phone at (713)-491-4298 or +44-(20)-45520800. Allow us to serve as your trusted partner in your journey toward cloud migration and meticulous data management within the finance sector.