Purchasing insurance and knowing it’s your shield for all your precious possessions is like having a superpower, isn’t it?

Absolutely!

In today’s changing world, having insurance is like wearing a life jacket that assures financial security during life’s most challenging and unpredictable moments. Among the many types of insurance we purchase in our everyday lives, health insurance is the most common one in the world. In the United States, around 91.4 percent of people had health insurance in 2020, compared to around 84 percent in 2010. Several companies worldwide have partnered with health insurance companies to offer their employees free health insurance. As a result, it is not surprising that this industry is expanding rapidly due to increasing demand.

Health insurance companies have always relied on data to develop mathematical models to predict outcomes and use the information they collect during the onboarding process to facilitate customer interaction.

Various departments within the company deal with various sets of data.

- Sales Department: It has access to a CRM system that includes clients’ PII data, including email addresses, phone numbers, names, addresses, etc.

- Operation Department: Post-sales, this department picks up customer forms and forward it to the underwriting department. This department’s work is in terms of dealing and building policies and with customer information. This information is shared periodically with sales, underwriting teams, and customers based on their needs.

- Underwriting Department: An insurance underwriter evaluates the applications to decide whether to provide the coverage and establish coverage amounts and premiums. Underwriters connect insurance agents eager to sell policies with insurance companies looking to minimize risk. An applicant for health insurance is evaluated based on his/her medical history to determine the premium rate and whether the coverage will be offered.

These are just a few of the departments within the health insurance companies that collect, share, and store customers’ medical and personal data to extract value for a number of purposes.

Data management is at the heart of the insurance industry, but there are some challenges that insurance companies face on a day-to-day basis. Here are the critical ones:

- Legacy infrastructure that acts as a roadblock to efficient data management

- Data silos across different departments

- Duplicate data across various departments that add to data sprawl

- Unsecured and ungoverned customer PII data

- Inefficient data access and sharing

- Laws such as Health Insurance Portability and Accountability Act (HIPAA) and others complicate data management in the healthcare industry.

Can insurance companies find a solution to their data management challenges?

Enterprise data is often siloed and stored in multiple data lakes across various departments.

What is a data lake? – A data lake is a repository that allows you to store all your structured and unstructured data at any scale.

Consider a situation where marketing and HR are working on an employee engagement project. Both teams are using separate data lakes to store their project plans and have multiple versions of employee PII data in them. Isn’t much of this information similar? What about security? What about access controls? What about compliance? What about cross-department analysis? Both teams must ensure all of this but twice. Both teams are recording information about the same employee and running two separate inferences for the employee. Now, think about this same exercise for a billion-dollar enterprise and calculate the time and effort involved. Analytics, security, and compliance must be assured for probably the same information 100s and 1000s of times. And what happens if there’s a misstep and the security of the data is compromised? It’s a breach and enterprises end up paying millions of dollars.

Thousands of data lakes hold an enterprise’s an employee/customer information and they have no idea how to consolidate, manage, drive intelligence, and secure it. This is what we call a sprawl of unstructured data. The data is siloed, duplicated, unsupervised, and unknown, posing several challenges including the proliferation of unstructured data, a lack of data knowledge, sharing of sensitive information without adequate access controls, and a multitude of duplicated files that create security risks and complicate data management.

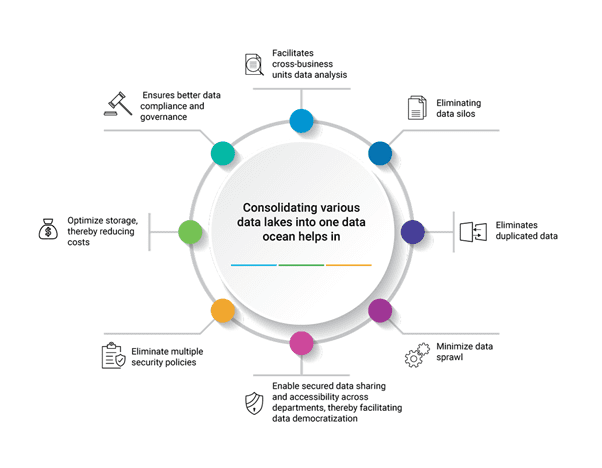

Companies must integrate these data lakes into one centralized repository for secure data sharing and robust PII data privacy and protection. Data oceans are an excellent choice for consolidating data lakes. Data oceans exist in the cloud.

What is a data ocean? DataOceans offers one comprehensive platform that optimizes your data to deliver more effective communications across your enterprise and better customer experiences & business outcomes, enabling long-term growth.

Here’s how this works:

- Identify the various data lakes that you’d like to consolidate. You can prioritize depending on the similarities of the projects run by departments or based on the need for cross-department analysis.

- Analyze your data to identify duplicate/redundant/obsolete data and eliminate/archive

- Consolidate the data files

- Implement the right security measures to safeguard your PII/business-critical data such as access controls and quarantine

- Ensure adherence to compliance and governance with audit logs

- Move the data to a centralized repository in the cloud – a data ocean

As you can see, this is one-time activity as opposed to multiple rounds of data management, analysis, security, and compliance checks when data is stored in multiple data lakes.

Furthermore, having a core operational platform that provides a single point of truth for all stakeholders and the capability to share data with external collaborators in a secure manner is crucial in a data-driven world.

Join Data Dynamics on the road to effective data management

Data Dynamics is a leading provider of enterprise data management solutions via its Unified Unstructured Data Management Platform. The platform encompasses four modules- Data Analytics, Mobility, Security, and Compliance. Currently utilized by over 25% of the Fortune 100, the platform blends automation, AI, machine learning, and blockchain technologies, allowing organizations to utilize a single software platform to consolidate their data lakes, maximize the value of unstructured data, and secure it.

- Analytics: Through the analytics module of the platform, enterprises can gain a deeper understanding of the content and context of their data estates and subsequently delete duplicated data and intelligently archive by identifying files that should be moved to low-cost object storage for long-term archiving or cloud tiering. Additionally, they will be able to identify sensitive and personal data present at scale within different data lakes.

- Mobility: Help migrate petabytes of data across different data lakes into a single data ocean in the cloud with speed and accuracy.

- Security: Provides the ability to secure and protect personal, private, or business-critical data by quarantining and providing role-based access. Helps in generating immutable reports on that data to gain insights related to access and changes done.

- Compliance: Provides intelligent identification of data sets containing files containing content fields associated with regulatory requirements to support the strictest definition of privacy.

Dive into a data ocean to facilitate better data management now.

To know more, contact us solutions@datdyn.com or click here to book a meeting.