The global economy has faced significant hurdles in recent times, characterized by economic downturns, market instability, and disruptions stemming from diverse factors like the COVID-19 pandemic. These circumstances have had a profound impact on every sector including banking, especially traditional banks. Confined by outdated systems and bureaucratic procedures, they have encountered numerous difficulties in adapting to rapidly changing market dynamics. The decline in consumer spending, the rise in loan defaults, and a slowdown in business activity have exerted immense pressure on the profitability and stability of banks. Traditional bankers today are being forced to reassess their strategies, embrace digital transformation, and explore innovative methods to navigate the uncertain landscape. In this stimulating context, fintech companies have emerged as resilient beacons, giving traditional banks a run for their money.

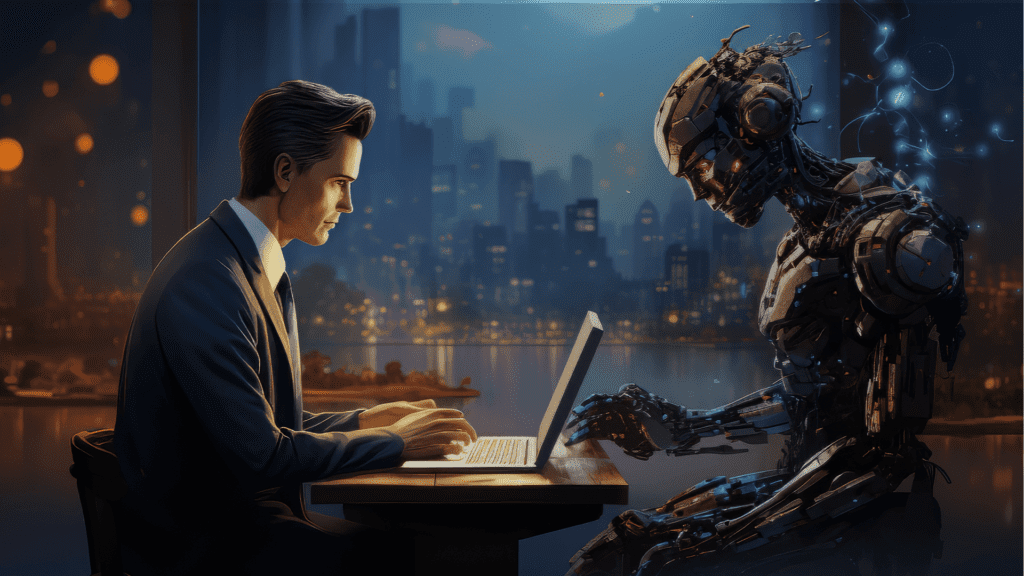

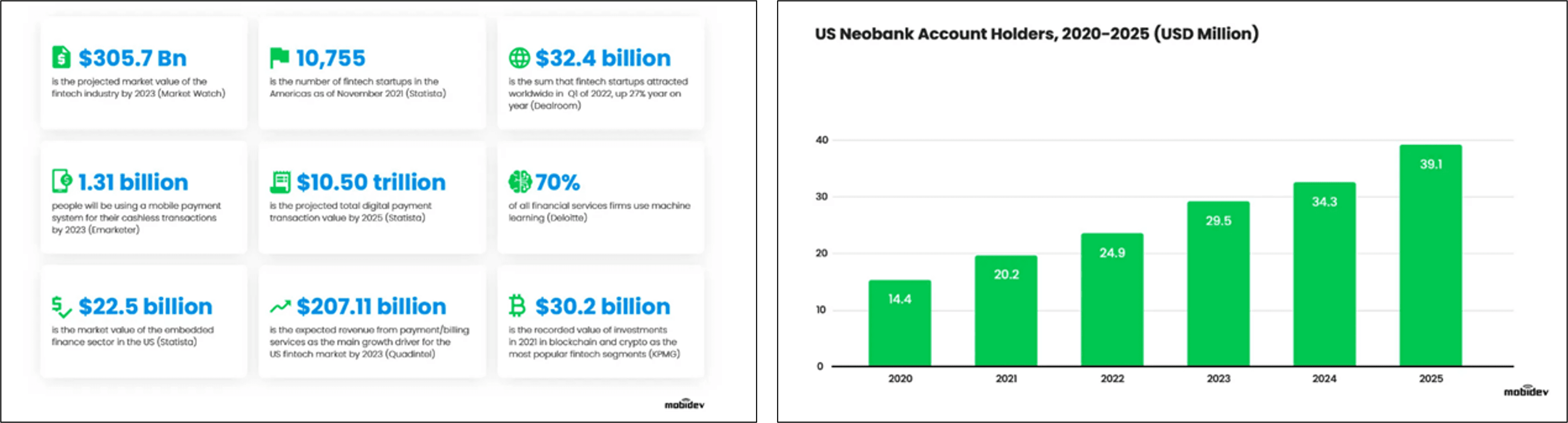

Fintechs, an exciting amalgamation of technology and finance, revolutionizes the way we manage money by leveraging innovative technological solutions. This market is expected to grow at a CAGR of 23.58% from 2021 to 2025 (Research and Markets, 2020). As of 2023, the global fintech market is valued at about $165.17 billion.

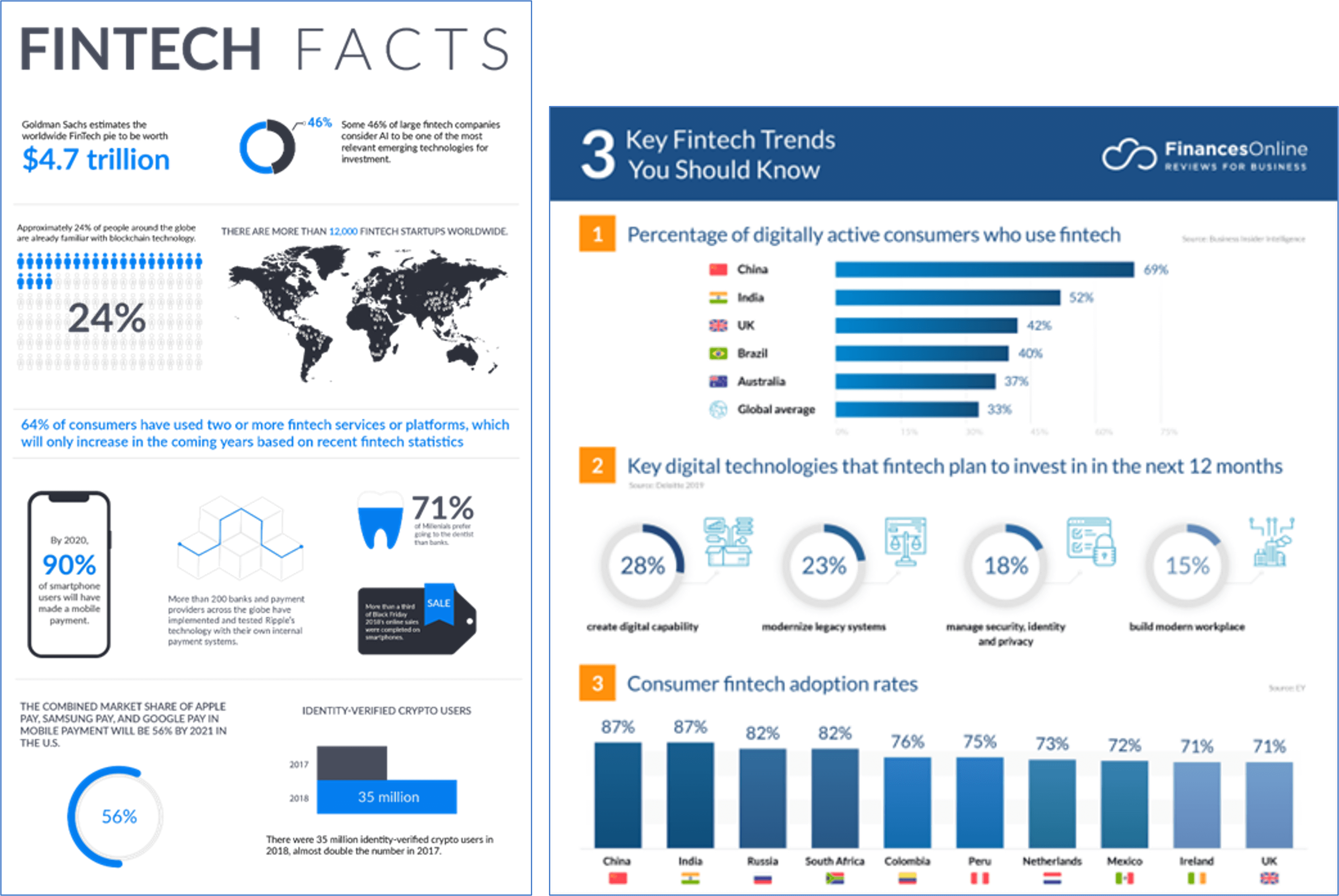

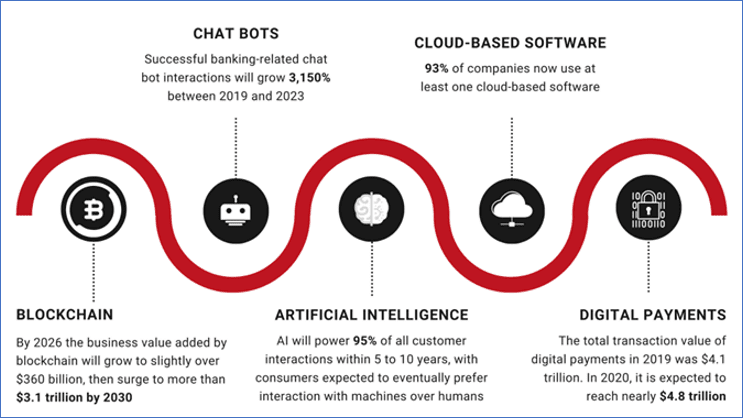

Fintechs encompass a diverse array of digital tools, such as mobile banking applications, peer-to-peer lending platforms, robo-advisors, blockchain-based cryptocurrencies, and more. They harness cutting-edge technologies like artificial intelligence, big data analytics, and cloud computing to create streamlined, customer-centric financial experiences. In fact, artificial intelligence is one of the leading technologies in the fintech market, with a market share of 38.25% in 2019 (Research and Markets, 2020). With their agile and disruptive approach, fintechs actively challenge traditional banking models, introduce novel business frameworks, and drive the digital transformation sweeping across the financial industry. Given the current macroeconomic climate, fintech companies have surfaced as visionary leaders and triumphant entities, thanks to their strategic utilization of data to confront the economic decline. The crux of their accomplishment lies in their ability to efficiently handle and leverage data. Let us delve into the details and explore how they achieve this feat.

Data-driven Innovations: How Fintechs Thrive in Challenging Times

Presently, we are witnessing widespread layoffs across companies of all sizes. Even prominent tech giants like Microsoft, Salesforce, and Oracle have resorted to substantial layoffs to prepare for a decline in demand and preserve their financial resources. Smaller companies, facing both an economic slowdown and investor reluctance to invest, also find themselves compelled to downsize their workforce in order to save money and mitigate risks. While these responses to a recession are to be expected, it’s worth noting that we are also experiencing a surge of innovation and new approaches across various industries.

Technologies such as artificial intelligence (AI), mobile applications, decentralization, enhanced customer experiences, real-time analytics, and actions are revolutionizing the way businesses operate.

These innovative approaches generate a demand for further advancements and drive significant changes in processes. Its worthwhile to note that the key to success here, lies in the effective utilization and harnessing of data. Even in times of uncertainty, one thing remains certain: the degree to which data is leveraged determines the level of achievement.

This is precisely where fintech companies shine, stealing the spotlight.

Data is being generated at an exponential rate, yet many organizations struggle to effectively utilize this valuable resource. Surprisingly, studies reveal that approximately 90% of data remains untouched and ultimately gets discarded. While the importance of data is widely acknowledged, not every company possesses the capacity to capture and process it in a timely manner to foster business growth. However, fintech companies stand apart. They have showcased their remarkable ability to leverage data as a potent tool for navigating uncertainties and driving success. These innovative firms have harnessed vast volumes of data, employing advanced analytics and machine learning algorithms to extract invaluable insights from historical trends, market dynamics, and customer behavior. Drawing from common patterns and trends observed during the 2008 recession, they are now equipped to formulate predictive theories about the current market landscape and determine strategies not just for sustainability but also for growth when other players may be slowing down. This unique competitive edge is founded upon their mastery of effectively utilizing and harnessing data, serving as the bedrock of their remarkable achievements.

Some of the fintech companies that are acing it at the moment are:

- Robinhood is a stock trading app that allows users to buy and sell stocks without paying any commissions. The company has seen its user base grow from 1 million users in 2019 to 22 million users in 2022.

- SoFi is a financial technology company that offers a variety of financial products, including student loans, personal loans, and mortgages. The company has seen its loan volume grow from $1 billion in 2019 to $10 billion in 2022.

- Square is a payments company that allows businesses to accept credit and debit cards. The company has seen its revenue grow from $2.2 billion in 2019 to $5.6 billion in 2022.

- PayPal is a digital payments company that allows users to send and receive money online. The company has seen its user base grow from 346 million users in 2019 to 426 million users in 2022.

- Stripe is a payments company that allows businesses to accept credit and debit cards online. The company has seen its revenue grow from $2.9 billion in 2019 to $6.4 billion in 2022.

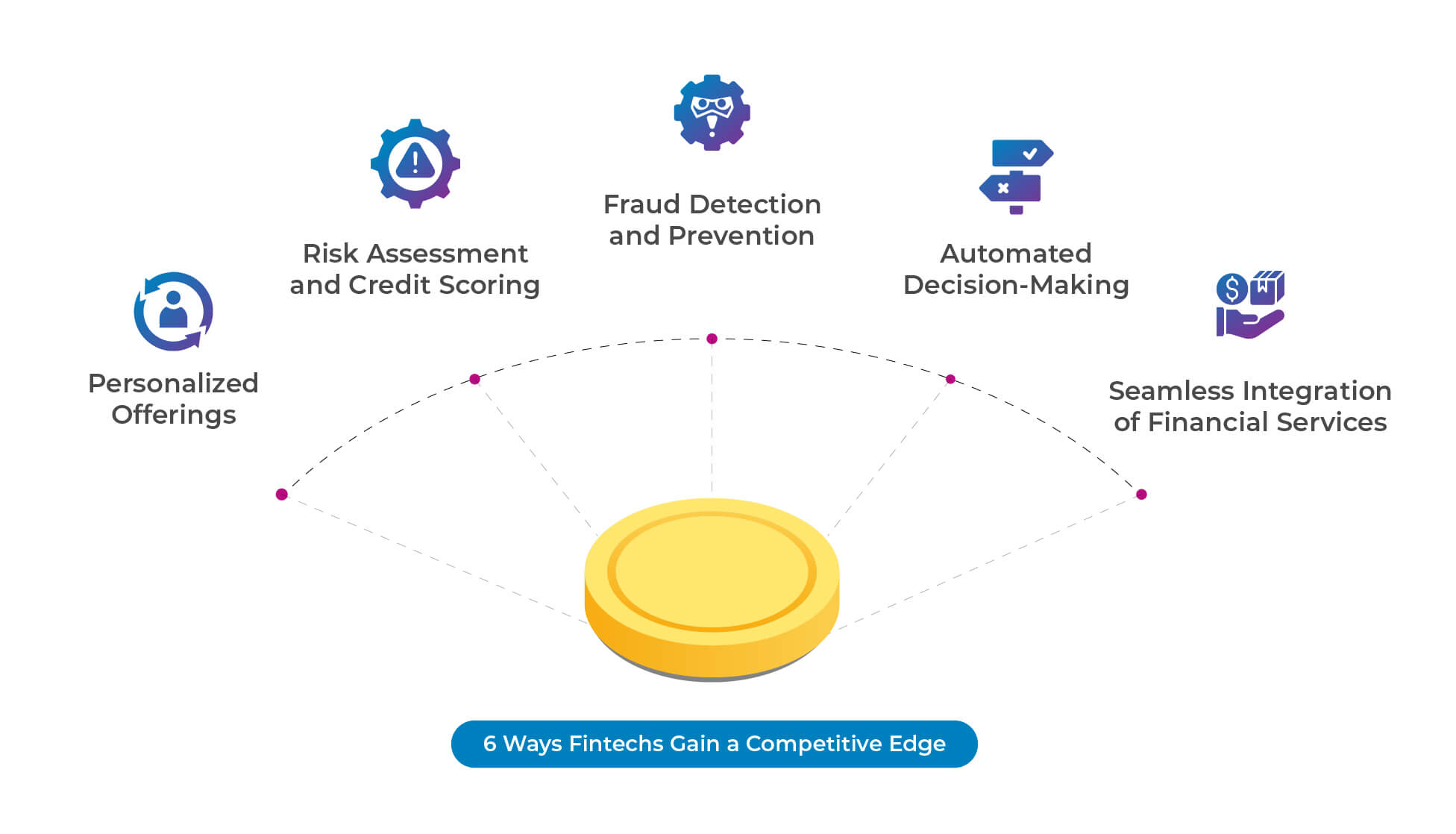

Unleashing the Power of Data: 6 Ways Fintechs Gain a Competitive Edge

- Personalized Offerings: Fintechs analyze customer data to understand individual preferences, spending patterns, and financial goals. By applying advanced analytics and machine learning algorithms, they can provide personalized financial recommendations, tailored product offerings, and targeted marketing campaigns. This level of personalization allows fintechs to deliver a superior customer experience compared to traditional banks, which often offer more generic services.

Example: Wealthfront, a robo-advisor, analyzes customer data to create personalized investment portfolios.

Technologies used: Advanced analytics, machine learning algorithms, customer profiling, and data segmentation. - Risk Assessment and Credit Scoring: Fintechs utilize vast amounts of data, including alternative data sources, to develop sophisticated risk assessment models and credit scoring algorithms. They can evaluate an individual or business’s creditworthiness more accurately by analyzing factors beyond traditional credit scores. This enables fintechs to offer loans and financial services to underserved populations or those with limited credit history, providing a competitive advantage over traditional banks with more rigid credit assessment processes.

Example: ZestFinance utilizes alternative data sources and machine learning algorithms to assess credit risk for underserved borrowers.

Technologies used: Machine learning, predictive analytics, alternative data integration, and credit modeling. - Fraud Detection and Prevention: Fintechs employ advanced data analytics techniques to identify patterns and anomalies that indicate fraudulent activities. By continuously monitoring and analyzing large volumes of transactional and behavioral data, they can detect and prevent fraud more effectively than traditional banks. Real-time fraud detection systems powered by data-driven algorithms contribute to enhanced security measures and customer trust.

Example: Feedzai employs artificial intelligence and machine learning to identify fraudulent activities in real-time for financial institutions.

Technologies used: Artificial intelligence, machine learning, anomaly detection, behavioral analytics, and real-time data processing. - Automated Decision-Making: Fintechs leverage data and machine learning algorithms to automate decision-making processes. This enables them to provide faster loan approvals, risk assessments, and investment recommendations. By reducing manual intervention and relying on data-driven insights, fintechs can make quicker and more accurate decisions, enhancing efficiency and customer satisfaction.

Example: SoFi, an online lending platform, uses data analytics and algorithms to automate loan approval processes.

Technologies used: Data analytics, machine learning, decision models, and automated workflows. - Seamless Integration of Financial Services: Fintechs aggregate and analyze data from various sources, allowing them to offer seamless integration of financial services. They can consolidate information from different accounts, institutions, and platforms, providing customers with a comprehensive view of their financial health. In contrast, traditional banks often struggle with data integration due to legacy systems, making it challenging to offer such seamless experiences.

Example: Mint, a personal finance management platform, aggregates data from various financial accounts and provides a consolidated view.

Technologies used: Data aggregation, API integrations, data analytics, and data visualization. - Predictive Analytics: Fintechs utilize historical data and market insights to develop predictive models and anticipate customer needs. By understanding customer behaviors and market trends, they can proactively offer relevant products and services, creating a competitive edge. Traditional banks, while recognizing the value of predictive analytics, may face challenges in extracting actionable insights from their data due to legacy systems and fragmented data sources.

Example: Ant Financial utilizes customer data and machine learning algorithms to offer personalized product recommendations and financial services.

Technologies used: Machine learning, predictive modeling, customer segmentation, and real-time data analysis.

Top 5 Learnings for Traditional Bankers in the Era of Fintech Data Revolution

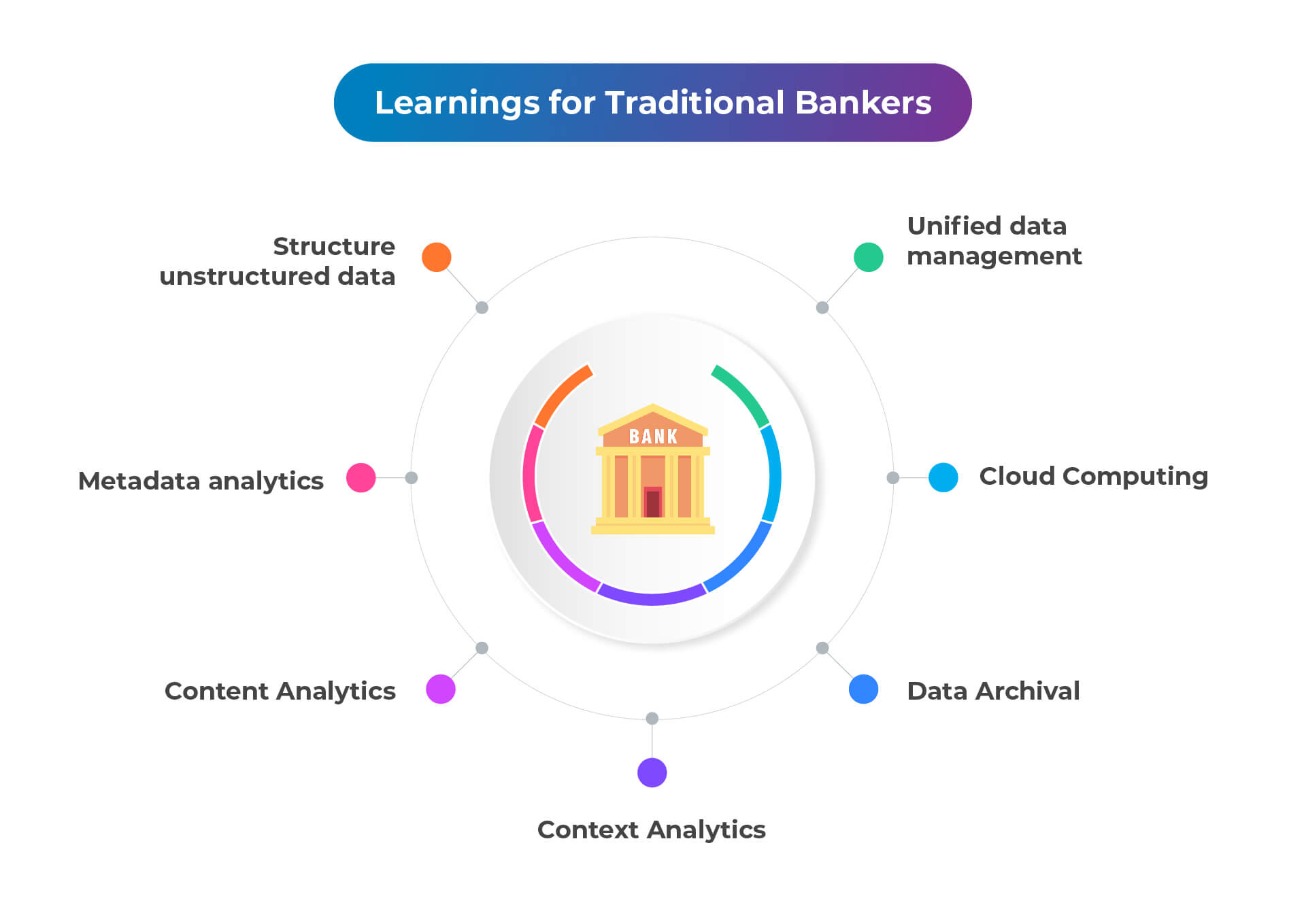

In order to thrive in the fast-paced and competitive world of finance, traditional bankers must adopt fresh approaches to managing data, particularly in dealing with unstructured information. The financial services industry globally generates a staggering amount of data each year, estimated at 2.5 quintillion bytes. Surprisingly, 80% of this data remains unstructured, with only 12% being effectively analyzed. This amounts to an alarming 88% of wasted data. Can bankers truly afford this, especially when faced with fierce competition from data-savvy rivals? The answer is a resounding no. So, what lies ahead? How can traditional bankers revamp their operations and maintain their competitive edge?

Here are six captivating strategies that can empower traditional bankers to outshine their fintech counterparts, unlocking a wealth of insights and seizing new opportunities.

- Structuring unstructured data is a monumental task that requires bankers to shift their perspective. Unlike traditional banking data, which is often organized and easily accessible, fintech data can be unstructured and messy. It may include social media posts, customer reviews, or even sensor data from wearable devices. Traditional bankers must learn to embrace technologies like natural language processing (NLP) and machine learning to make sense of this unstructured data. By extracting relevant information and categorizing it effectively, bankers can gain a deeper understanding of customer behavior, market trends, and potential risks.

- Now, let’s talk about metadata, the silent hero that holds the key to unlocking valuable insights. Metadata provides context and meaning to raw data, allowing bankers to quickly identify patterns, relationships, and trends. By enriching their data with metadata, bankers can categorize information, track its source, and establish connections between various data points. This metadata-driven approach enables bankers to make data-driven decisions with confidence and agility. Whether it’s analyzing customer preferences, identifying fraud patterns, or optimizing risk management, metadata becomes the guiding light that illuminates the path to success.

- Content and context analytics take data analysis to a whole new level for traditional bankers. With the help of advanced analytics tools, bankers can delve into the content of data, uncovering valuable insights that were previously hidden. By analyzing customer interactions, sentiment analysis, and social media trends, bankers can gain a deeper understanding of customer needs and preferences. This newfound knowledge empowers them to tailor their offerings, personalize customer experiences, and build stronger, long-lasting relationships. In the age of fintech, where customer-centricity is paramount, content and context analytics are the secret sauce that can give traditional bankers an edge. Also, content analytics is an excellent tool when it comes to identifying PII data amidst unstructured data sprawls and implementing robust protocols for data security & data protection – quarantining, access control, intelligent file-repermissioning and immutable audit logs.

- Archiving data might not sound like the most exciting topic, but it holds immense value for traditional bankers. By effectively archiving data, bankers can access historical information, compare past and present trends, and identify long-term patterns. This historical perspective is invaluable when it comes to making strategic decisions, mitigating risks, and complying with regulatory requirements. Moreover, archived data can be a goldmine for uncovering hidden opportunities or avoiding potential pitfalls. By treating data as a valuable asset and archiving it appropriately, bankers can tap into the wisdom of the past and secure a competitive advantage.

- Then comes, the cloud — the game-changer that revolutionizes data storage and accessibility. Cloud solutions offer traditional bankers a secure and scalable platform to store, process, and analyze vast amounts of data. The cloud empowers bankers to leverage advanced analytics tools, artificial intelligence, and machine learning algorithms without the burden of maintaining costly infrastructure. It enables real-time collaboration, enhances data security, and ensures regulatory compliance. By embracing cloud solutions, traditional bankers can not only level the playing field with fintech companies but also surpass their capabilities by leveraging the benefits of scalability, agility, and cost-efficiency.

- And finally, unified data management. Revamping traditional banking practices by implementing unified data management brings an exhilarating opportunity for bankers to surpass fintech companies. The process involves amalgamating and harmonizing diverse data sources, empowering traditional bankers with a single-pane and all-encompassing view of their operations, customers, and market trends. This comprehensive understanding acts as a catalyst for making astute decisions, spotting emerging opportunities, and effectively managing risks. Through unified data management, the barriers between information silos are shattered, allowing seamless data flow across departments and systems. This cohesive and integrated data ecosystem not only amplifies operational efficiency but also revolutionizes customer experience by enabling tailor-made and precise offerings. Moreover, unified data management streamlines regulatory compliance by ensuring accuracy and traceability of data throughout the organization.

In conclusion, traditional bankers have a golden opportunity to leverage fintech data by adopting innovative approaches to data management. By structuring unstructured data, harnessing the power of metadata, embracing content and context analytics, effectively archiving information, and leveraging cloud solutions, bankers can unlock a world of insights and opportunities. The key learnings for traditional bankers are clear: adapt, innovate, and seize the transformative potential of fintech data. By doing so, bankers can not only survive but thrive in the age of disruptive financial technologies. The future is bright, and the path to success lies in the hands of those willing to embark on this exciting journey of data-driven banking.

The Data Dynamics Advantage

As mentioned earlier, fintech start-ups have ignited a wave of excitement in the financial industry by offering customers innovative alternatives to traditional solutions. The current pandemic has further accelerated their growth, turning them into an integral part of life for GenZ and Millennials. Even tech giants like Apple, Google, and Amazon have jumped into the fintech market, introducing e-banking platforms that pose a threat to the established banking ecosystem. Today, an impressive 65% of consumers embrace digital banking, while an astounding 90% of fintech companies credit their success to enhanced client experiences. This rapid rise of fintech, coupled with economic shifts and regulatory changes, has fundamentally transformed the face of banking and financial services.

Fintech start-ups are fortunate to have emerged in a world teeming with cutting-edge technologies such as RPA, cloud computing, blockchain, AI, and ML, granting them a unique advantage over traditional financial players hampered by outdated infrastructures and untapped data reserves. Yet, if harnessed securely and effectively, this data has the potential to unlock unparalleled competitive advantages. Sadly, the data currently resides in isolated silos, hindering the ability to fully exploit its value. A staggering 80% of the stored data in this industry remains unstructured, with less than 1% of that unstructured data evaluated or utilized for decision-making. As guardians of this vast amount of data, financial services organizations face the distinctive challenge of managing and making sense of unstructured data to provide personalized, cutting-edge customer service. However, unraveling the complexities of massive unstructured data sets can be daunting. Where is the data? Who can access it? Is it secure and compliant?

In this exhilarating landscape, Data Dynamics steps in to help the BFSI industry harness the incredible knowledge and expertise embedded within their own organizations’ data, ultimately delivering both immediate and long-term business value. As a leading provider of enterprise data management solutions, Data Dynamics offers the Unified Unstructured Data Management Platform, empowering organizations to structure their unstructured data effectively. The platform encompasses four modules – Data Analytics, Mobility, Security, and Compliance. Proven in over 300+ organizations, including 28 Fortune 100 companies and six of the world’s largest banks, this comprehensive platform acts as a one-stop solution, enabling financial organizations to fully capitalize on the capabilities of unstructured and high-volume data, thus attaining and maintaining a competitive edge.

With Data Dynamics, financial enterprise customers can eliminate the use of individual point solutions with siloed data views. Instead, they can utilize a single software platform to structure their unstructured data, unlock data-driven insights, secure data, ensure compliance and governance and drive cloud data management.

To discover more about how Data Dynamics can help you streamline your data management, please visit www.datadynamicsinc.com or contact us at solutions@datdyn.com / (713)-491-4298 / +44-(20)-45520800.