The banking world is buzzing with change, and it’s about time. Between regulatory mandates, new technological innovations, and customers wanting their finances served up like a Spotify playlist—personalized and seamless—the industry is shifting gears. And right at the center of this revolution is open banking, a concept that’s gone from a theoretical “maybe someday” to “it’s happening, and it’s happening now.”

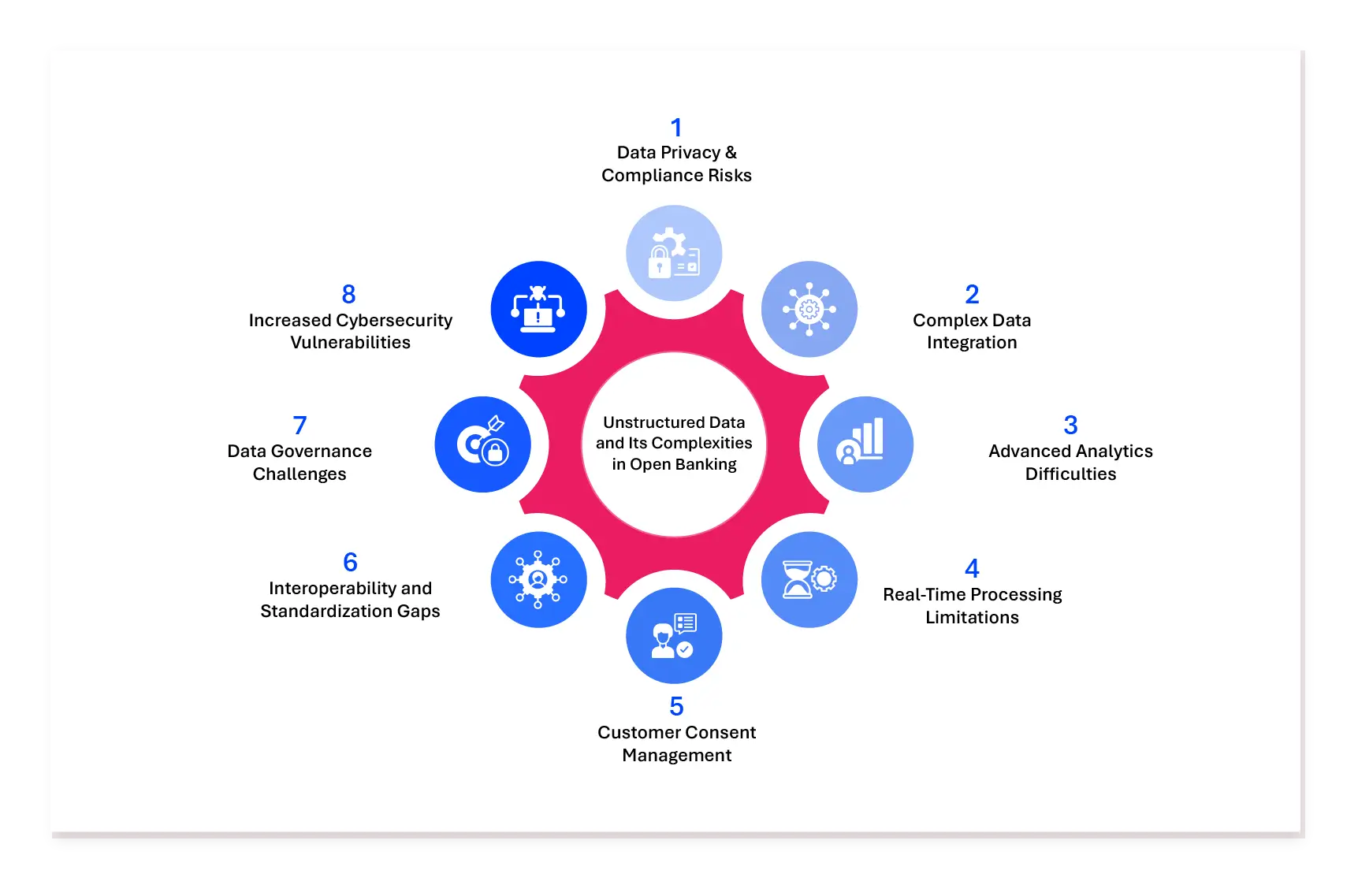

But as promising as open banking sounds, it’s also exposing critical vulnerabilities—particularly around unstructured data and compliance. For those who still view regulatory compliance as a checkbox exercise, it’s time to rethink. In this era of data democratization, ticking regulatory boxes isn’t just insufficient—it’s a potential recipe for disaster.

Open Banking: A Game-Changer (With a Side of Chaos)

Open banking, driven by regulations such as the European Union’s Payment Services Directive 2(PSD2), enhances consumer protection and electronic payment security. Additionally, the Consumer Financial Protection Bureau (CFPB) guidelines in the U.S., mandates that financial institutions, credit card issuers, and other financial providers must provide individuals with free access to their personal financial data and enable its transfer to another provider upon request. At its core, open banking is about empowering customers by giving them greater control over their financial information. By mandating that banks securely share consumer data with third-party providers, it puts individuals in control of their financial information. The result? A financial ecosystem that’s more inclusive, competitive, and innovative.

This shift has opened a world of possibilities. Think of an app that not only tracks your spending but also provides personalized investment advice, predicts cash flow issues, and even cancels unused subscriptions. That’s the promise of open banking. But behind the scenes, this data-sharing and customer experience revolution creates a storm of unstructured data that traditional compliance frameworks were never designed to handle.

Unstructured Data: The Enterprise Blind Spot

Let’s talk about unstructured data—the wild west of banking. It’s everywhere: scanned loan documents, chatbot complaints, emails from customers asking why their mortgage rate isn’t what they expected. This data could unlock some serious insights if managed well, but it’s also a compliance landmine waiting to explode.

Take a page from Metro Bank’s compliance failure to understand the risks of unstructured data mismanagement. Between 2016 and 2020, the bank’s financial crime monitoring system failed to process over £51 billion in transactions due to its inability to effectively handle unstructured data. This data, scattered across various sources and formats, went unmonitored despite internal warnings, leading to a £16.7 million fine from the FCA. The incident illustrates that without proper governance and tools to manage unstructured data, financial service enterprises face significant compliance risks and regulatory penalties.

Now imagine this: a bank processes a mortgage application. The applicant emails their tax returns, pay stubs, and a scanned passport. These files end up floating around in an email thread accessible to half the office. One accidental “reply all” later, and those sensitive docs are sent to a vendor who has no business seeing them. It’s a small mistake with potentially massive consequences.

For instance, remember the Capital One data breach of 2019? It’s the corporate equivalent of locking your front door but leaving your windows wide open. A former employee of a cloud service provider orchestrated the breach, exposing sensitive information of over 100 million customers, including Social Security numbers, credit scores, and banking details. Much of this data was unstructured scattered across systems without proper encryption or access controls. A hacker strolled through a misconfigured firewall and made off with sensitive info, including scanned personal IDs. The aftermath? A $190 million settlement and a reputation that’s probably still in counseling.

And let’s not forget compliance. We need to be honest: enterprises have a habit of doing the bare minimum when it comes to regulatory compliance. It’s not because they don’t care; it’s because they’re juggling a million priorities. But this “box ticking exercise” approach doesn’t cut it anymore. Meeting compliance requirements on paper might give a false sense of security, but it falls short if unstructured data remains unmanaged. According to IBM’s 2024 Cost of a Data Breach Report, the financial sector is the primary target for cyberattacks, with the average cost of a breach reaching $6.08 million—22% higher than the global average.

In the context of open banking, the risks surrounding unstructured data grow exponentially. Each new API integration—a cornerstone of open banking—expands the attack surface. APIs facilitate data sharing and seamless customer experiences, but they also generate a flood of unstructured data, from logs and error reports to exchanged documents. Without proactive governance, this data becomes a liability rather than an asset.

The reality is clear: compliance in the open banking era isn’t just a box to tick—it’s a call to rethink how financial institutions manage and protect unstructured data. Open banking amplifies the need for modern, agile compliance strategies. Continuing to rely on outdated methods is like using an old map to navigate today’s rapidly evolving terrain. Regulatory scrutiny is intensifying, and the stakes for falling short have never been higher. To thrive, banks must embrace modern tools and frameworks designed to transform unstructured data from a risk into a competitive asset.

So, how can financial institutions turn compliance from a regulatory obligation into a strategic advantage?

A Fresh Perspective: Rethinking the Rules with a 360-Degree Compliance Framework

The solution lies in shifting mindsets and embracing a phased, intentional approach to addressing the complexities of unstructured data. That’s where the 360-Degree Compliance Framework comes in. With six actionable steps, it equips enterprises to modernize compliance processes and seize the opportunities open banking offers.

- Adaptive AI: The Cornerstone of Modern Governance

Adaptive AI is basically AI that learns and evolves on the go—it doesn’t just stick to what it was programmed for. It adjusts and improves in real-time, keeping up with changes and staying relevant no matter what’s thrown at it. Think of it as a Swiss Army knife, powered by machine learning (ML) and natural language processing (NLP), slicing through the chaos to find clarity – through automated discovery and classification.

Adaptive AI goes beyond finding Personally Identifiable Information (PII) or Protected Health Information (PHI) by actually understanding the context. It analyzes metadata, deciphers risks in real-time, and recommends preventative measures that go beyond compliance checklists. With integrated dashboards giving you a bird’s-eye view across decentralized systems, it’s like having a command center for your entire data ecosystem. This isn’t about playing defense anymore—it’s about flipping the game, moving from reactive to proactive governance. In a landscape where complexity reigns, adaptive AI isn’t just an option; it’s the cornerstone of intelligent governance.

- Privacy by Design: Embedding Security into Every Process

Data privacy in today’s digital economy is non-negotiable. Enterprises need to weave privacy into every process because, let’s be real, vulnerabilities are lurking in every corner of a modern organization. Privacy-Enhancing Technologies (PETs) like homomorphic encryption and data masking are game-changers here. Homomorphic encryption lets you work with encrypted data without ever exposing it—a dream come true for industries grappling with sensitive information.

Real-time dashboards take this a step further, offering tools that map out compliance risks and enforce governance policies dynamically. Imagine knowing in real-time which data is at risk, where it’s vulnerable, and how to fix it. Organizations that bake privacy into their data strategies don’t just meet regulations like GDPR and CCPA—they lead. They show customers, regulators, and competitors alike that trust and accountability are at the heart of their operations.

- Fortifying APIs: Security as the Backbone of Innovation

APIs are the invisible highways of our digital world, connecting apps, systems, and users in ways we take for granted. But as APIs increasingly interact with unstructured data like emails, documents, and logs, their vulnerabilities grow.

Here’s the fix: AI-powered threat detection systems that monitor API traffic in real-time, spotting anomalies before they spiral into breaches. Role-based access controls (RBAC) ensure the right people access the right data, while dynamic policy enforcement—think token validation and end-to-end encryption—keeps interactions secure. Real-time dashboards and reporting tools further enhance API security by offering visibility into traffic patterns, highlighting potential vulnerabilities, and guiding actionable remediation. With APIs acting as the conduits of modern open banking, securing them is doing much more than preventing breaches. It’s fostering trust, enabling innovation, and ensuring these digital lifelines remain resilient and secure.

- Zero Trust Models: Redefining Security Assumptions

Let’s face it: in today’s decentralized world, trust is a liability. The Zero Trust model flips the script. It assumes no one and nothing—user, device, or system—is trustworthy until proven otherwise. Continuous verification becomes the norm, ensuring that every data interaction passes the security litmus test. This architecture is particularly critical in decentralized environments where traditional perimeter-based security models fall short.

Granular access controls such as role-based and policy-driven mechanisms, integrated with Active Directory or similar systems, organizations can ensure that only authorized users access sensitive data. Now coupled with decentralized identity solutions like blockchain-based credentials, create an ecosystem where security is inherent. They’re dynamic measures, evolving with every interaction. Add in adaptive behavioral analytics, and you’ve got a setup that flags risks in real-time and allows for rapid response.

- Real-Time Compliance: Dynamic Oversight for Dynamic Data

Compliance used to be a static goalpost. Today, it’s a moving target, and enterprises need to play the game differently. Enter real-time compliance—a dynamic, cloud-native approach that blends data lifecycle insights with immutable distributed ledger technology (DLT). These tools provide unparalleled transparency and control, ensuring that compliance measures evolve in sync with regulatory changes and enterprise operations.

Automated workflows handle data archiving, retention, and deletion, to meet regulatory timelines without manual intervention. Meanwhile, DLT creates audit trails that are as tamper-proof as they are transparent. Additionally, customizable dashboards provide dynamic compliance insights, allowing organizations to track risk scores, map regulatory adherence, and implement corrective measures proactively. By integrating real-time compliance orchestration into their operational strategy, enterprises can ensure data flows remain auditable, secure, and aligned with legal requirements. This approach transforms compliance from a burdensome obligation into a strategic advantage, fostering trust, operational efficiency, and resilience in a rapidly changing regulatory landscape.

- Federated Data Management: Balancing Local and Global Compliance

In a world where “think global, act local” isn’t just a mantra but a necessity, federated data management is the bridge enterprises need. It’s about combining the strengths of decentralized data control with centralized policy enforcement.

These frameworks leverage hybrid cloud mobility, centralized governance, policy automation, and federated data management models to empower organizations to align operations with diverse regulatory landscapes seamlessly. Key capabilities include context-aware governance at the data source, ensuring sensitive data remains compliant with regional mandates such as GDPR, CCPA, or local data residency laws. By using metadata analytics, these frameworks classify and manage data dynamically based on jurisdictional rules, reducing the risk of non-compliance. Furthermore, policy-driven orchestration harmonizes local compliance needs with global operational strategies, fostering innovation without compromising regulatory adherence.

Federated data management also enhances visibility and control, allowing organizations to operate within a unified governance framework while granting data and application owners the autonomy to act on localized data requirements. This balance of local and global priorities ensures that enterprises not only meet current compliance standards but also build a robust, future-ready data ecosystem.

To Conclude…

The era of checkbox compliance is history, and there’s no going back. Open banking has arrived not as a gentle nudge but as an unrelenting force, compelling financial institutions to embrace a new paradigm where transparency, innovation, and data security are inseparable. Banks clinging to outdated practices risk falling behind—not just failing to keep up but sinking under the weight of unstructured data, tightening regulatory frameworks, and ever-evolving customer expectations.

The silver lining? Compliance, often viewed as a heavy burden, can become a launchpad for transformation. With the right strategies and solution, financial institutions can turn regulatory challenges into opportunities for growth, innovation, and trust-building.

One such solution is Zubin, an AI-powered self-service unstructured data management software from Data Dynamics. Designed to meet the demands of the open banking era, Zubin offers a strategic approach to managing unstructured data with unmatched precision. Its adaptive Data Analytics, Risk Management, Access Management, Centralized Governance Automation and Federated Data Management capabilities help banks transition from outdated compliance models to proactive, dynamic data governance. Additionally, Zubin’s data-sharing capabilities are exactly what open banking needs to thrive. Think about it—open banking is all about securely sharing data between banks, third-party providers, and customers while staying on top of strict regulations like GDPR or PSD2. With Zubin, you get role-based access controls, detailed sharing policies, and compliance tracking, so only the right people access the right data at the right time. It works across all kinds of storage—object, file, and pipelines—so collaboration is smooth and seamless. Plus, its self-service options make it super easy for teams to grab the data they need without jumping through hoops. It’s all about breaking down silos, driving customer-focused innovation, and keeping everything secure and compliant in today’s fast-moving financial world.

To know more about Zubin, visit www.datadynamicsinc.com, book a demo at https://www.datadynamicsinc.com/request-a-demo/ or email us at solutions@datdyn.com.