Highlights:

- Traditional financial institutions are adopting cloud technology to stay competitive in a landscape disrupted by agile FinTechs, relying on the cloud for innovation and efficiency. However, 94% fall prey to overspending.

- Implementing FinOps practices can lead to significant cost reductions, often exceeding 30%. It promotes efficiency, data-driven decision-making, and adherence to compliance standards, which are crucial in the financial sector’s regulated environment.

- Organizations like GE Digital, Finastra, Capital One, Nasdaq, and Square have harnessed FinOps principles to achieve substantial cost reductions while maintaining operational excellence.

- Microsoft Azure provides a suite of tools and services, including Azure Cost Management, resource tagging, Cost Explorer, Reserved Instances, Azure Advisor, and third-party integrations, to facilitate effective FinOps implementation for financial institutions.

In this Quick Byte:

In the ever-evolving landscape of financial services, cloud computing has emerged as a transformative force, reshaping how traditional banks and financial organizations operate. While traditional banks are gradually embracing the cloud, many FinTech companies have already raced ahead in harnessing its potential, leveraging their agility and digital-first mindset to gain a competitive edge in the financial industry.

This shift to cloud computing represents a significant departure from traditional IT infrastructure management. In the past, organizations would invest in physical hardware and software licenses, and these fixed costs remained relatively stable regardless of how much or how little they used their IT resources. However, with the advent of cloud computing, the rules of the game have changed. In recent years, traditional banks have embarked on a transformative journey to towards cloud migration, drawn by a compelling array of advantages such as cost-efficiency, scalability, and enhanced innovation capabilities.

In a cloud pay-per-use model, organizations are billed based on their actual consumption of cloud resources, such as virtual servers, storage, and data transfer. This means that every action and decision made within the cloud environment directly impacts the organization’s expenses. Running workloads, deploying applications, and storing data all come with associated costs, and these costs can quickly add up if not managed carefully. Organizations can no longer operate in the cloud with a “set it and forget it” mentality. They must now be acutely aware of the financial implications of their cloud usage. Ignoring or neglecting these cost considerations can lead to budget overruns, financial inefficiencies, and a competitive disadvantage.

- According to a report by Flexera, 30% of cloud spend is wasted.

- A study by Forrester found that 94% of enterprises are overspending in the cloud.

- The average enterprise spends an additional 30% on cloud computing than it originally planned.

Organizations are turning to a discipline known as “FinOps,” short for Financial Operations, to address this challenge. FinOps is a framework and set of practices designed to bring financial accountability and efficiency to cloud operations. It involves cross-functional collaboration between finance, IT, and operations teams to establish cost visibility, allocate cloud expenses accurately, and optimize spending.

FinOps helps organizations proactively manage their cloud spending to strike a balance between innovation and cost control. It provides tools, best practices, and guidelines to monitor usage, implement cost-saving strategies, and make data-driven decisions. By adopting FinOps principles, organizations can ensure they are getting the most value from their cloud investments while staying within budget constraints, ultimately helping them maintain competitiveness in an increasingly cloud-centric business landscape.

Why FinOps Is a Must-Have in the Cloud

In the cloud world, where costs can swing like a rollercoaster, FinOps is not just a nice-to-have—it’s a survival kit.

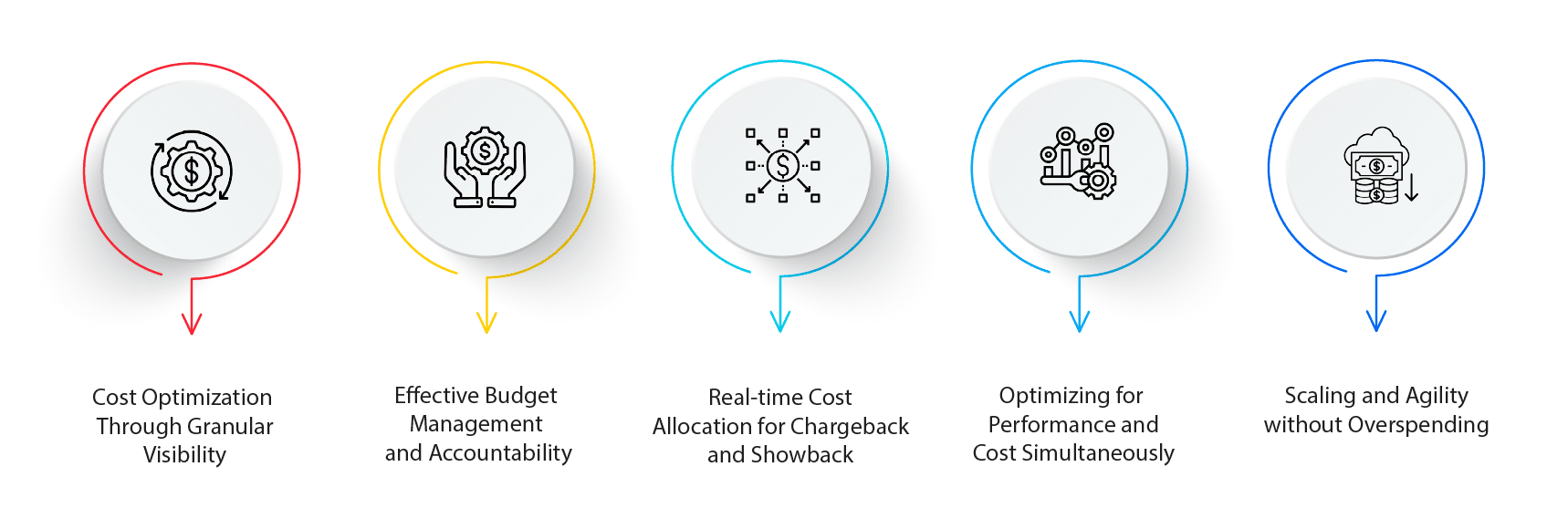

- Cost Optimization Through Granular Visibility: FinOps (Financial Operations) provides organizations with the tools and methodologies to gain granular visibility into their cloud spending. This goes beyond merely tracking overall costs and allows for detailed insights into which specific resources and services are driving expenses. With this level of visibility, companies can pinpoint inefficiencies, underutilized resources, and areas for optimization, ultimately leading to significant cost savings. According to a survey by Flexera, companies that implement FinOps practices reduce their cloud costs by an average of 30%, giving them a tighter grip on their financial plans.

- Effective Budget Management and Accountability: Cloud environments can quickly become cost centers that spiral out of control without proper oversight. FinOps establishes a framework for setting and managing budgets across different teams and projects. This not only encourages accountability but also empowers teams to make data-driven decisions about their cloud resource usage. Gartner estimates that up to 70% of cloud spending is wasted due to inefficiencies. FinOps turns off the lights in those empty rooms.

- Real-time Cost Allocation for Chargeback and Showback: One of the more advanced aspects of FinOps is the ability to implement real-time cost allocation. This feature allows organizations to attribute cloud costs directly to individual teams or projects, making chargeback and showback processes much more accurate and transparent. This streamlines financial reporting and facilitates fair resource allocation based on actual consumption. CloudHealth by VMware reports that organizations implementing chargeback/showback with FinOps can reduce wasted cloud spend by 25% or more.

- Optimizing for Performance and Cost Simultaneously: FinOps goes beyond cost-cutting and also considers performance optimization. By analyzing cost-performance trade-offs, organizations can strike a balance between achieving optimal cloud performance and keeping expenses in check. This approach ensures that cloud resources are used efficiently, enhancing both cost-effectiveness and user experience. A study by Flexera found that 67% of organizations believe optimizing cloud costs while maintaining performance is a significant challenge.

- Scaling and Agility without Overspending: Cloud environments enable businesses to scale quickly and adapt to changing demands. However, this scalability can lead to overprovisioning and overspending without proper financial management. FinOps provides the tools to monitor resource utilization and automate scaling decisions, ensuring that the organization can stay agile without incurring unnecessary costs. It allows for dynamic adjustments to resources based on real-time needs, preventing waste and promoting efficiency. According to McKinsey, organizations that embrace FinOps can improve cloud cost visibility by 30-40% and reduce wasted cloud resources by up to 35%.

5 Easy Steps to Implement FinOps for Cloud Cost Management

Now that we’ve demystified FinOps and its importance, let’s get down to brass tacks. How do you actually implement FinOps in your organization? Don’t worry; it’s not rocket science. Here are five straightforward steps:

- Form Your FinOps Team: You need the right people for the job. Appoint a FinOps team or designate a FinOps champion who will lead the charge. This team should be a mix of finance experts, IT wizards, and operations gurus. Why? Because FinOps is all about collaboration, and this team will be your task force for keeping costs in check.

- Shed Light on Your Spending: You can’t manage what you can’t see. Cloud-native tools like Azure Cost Management and AWS Cost Explorer are your trusty flashlights in this dark, twisty spending labyrinth. They help you gain visibility into your cloud expenses so you know exactly where your money’s going. According to Gartner, through 2025, over 95% of cloud security failures will be the customer’s fault, usually due to misconfigurations. Visibility is your shield against costly missteps.

- Set Budgets and Thresholds: Define clear budgets for your cloud resources. Set spending thresholds to trigger alarms when costs approach or exceed your limits. This keeps your spending in check and prevents any budgetary surprises. In fact, RightScale’s State of the Cloud Report found that 37% of respondents listed managing cloud costs as their top challenge. Budgets and thresholds are your safety nets.

- Embrace Continuous Optimization: Picture this: You’ve tuned up your car, and now it’s running like a dream. But it’s not a one-time job; you need to keep fine-tuning it regularly. The same goes for your cloud expenses. Continuously review your cloud usage and expenses. Identify areas where you can trim the fat, just like a fitness regimen for your budget. This ongoing optimization can lead to significant savings over time.

- Cultivate a Cost-Aware Culture: Last but not least, spread the word. Educate your teams about the importance of cost management. Make them aware of the impact their choices have on the bottom line. When everyone understands that efficient cloud usage affects the company’s financial health, you’re in business. In a world where IT spending is expected to reach 4.7 trillion USD in 2023, according to Gartner, every dollar counts.

Here are five examples of financial organizations and enterprises adopting FinOps principles and benefiting from cost optimization and better cloud management:

- GE Digital: General Electric’s digital division, GE Digital, adopted FinOps practices to optimize its cloud costs. By implementing a cloud cost management solution, they achieved an impressive 52% reduction in their AWS cloud costs, resulting in millions of dollars in savings. This success story showcases the potential of FinOps in large enterprises.

- Finastra: Finastra, a financial technology company, embraced FinOps to gain better control over its cloud spending. They leveraged FinOps best practices to reduce their cloud costs by 30% while maintaining their cloud infrastructure’s performance and reliability. This success demonstrates how FinTech companies can benefit from FinOps to improve their financial efficiency.

- Capital One: As a financial institution at the forefront of digital innovation, Capital One adopted FinOps principles to optimize its cloud expenditure. By creating a FinOps team and implementing cost management strategies, Capital One improved budget adherence, enhanced cost visibility, and achieved significant savings in cloud spending.

- Nasdaq: Nasdaq, a global stock exchange and technology company, recognized the importance of cost management in its cloud operations. By embracing FinOps principles, Nasdaq improved its cloud cost visibility, implemented budget controls, and identified cost optimization opportunities. This proactive approach resulted in cost savings and more efficient cloud resource utilization.

- Square: Square, a fintech company known for its mobile payment solutions, adopted FinOps practices to streamline its cloud spending. Square’s FinOps team implemented automated cost monitoring, analyzed usage patterns, and made data-driven decisions to optimize their cloud infrastructure. This approach helped Square maintain cost-effective operations while supporting its rapid growth in the financial technology sector.

The Future of FinOps in Cloud Cost Management

As the financial world continues its digital transformation journey and organizations increasingly rely on the cloud for their operations, the role of FinOps is set to become even more critical. Here’s a glimpse into the future of FinOps in cloud cost management:

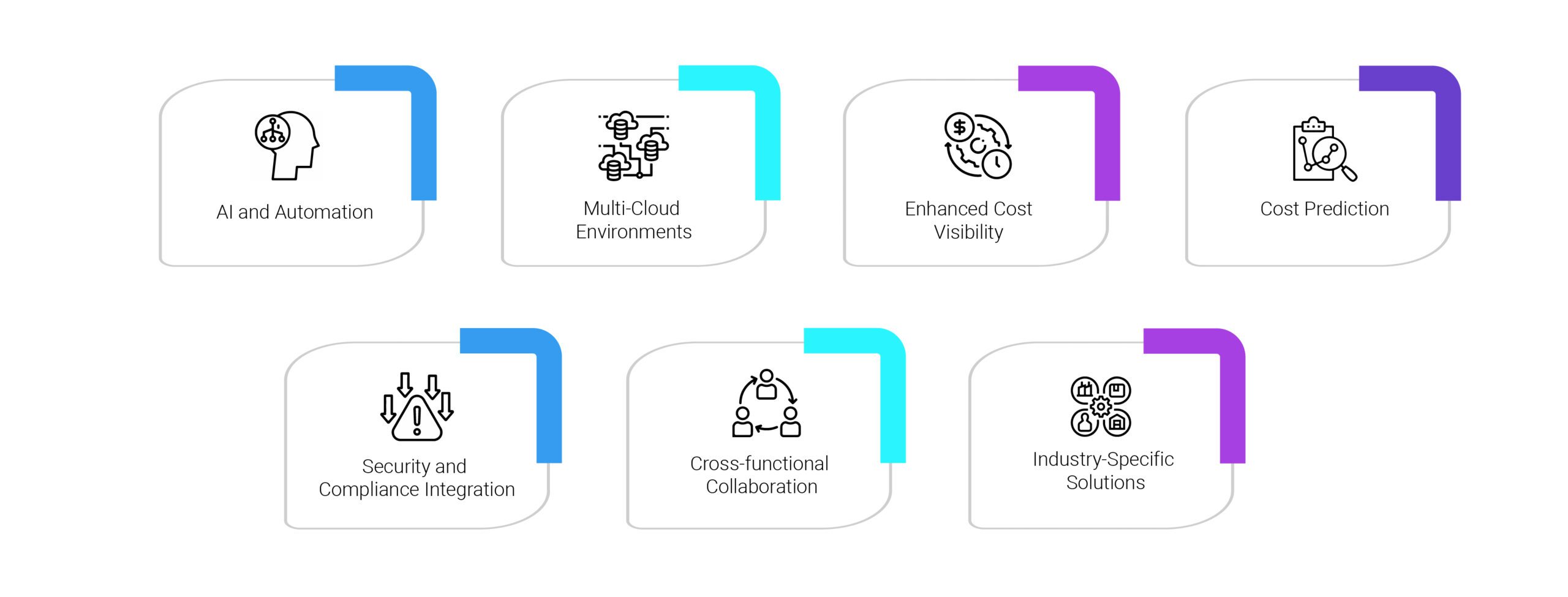

- AI and Automation: Expect to see more artificial intelligence (AI) and automation integrated into FinOps practices. AI-powered tools can analyze massive amounts of data in real time, providing instant insights and cost optimization recommendations. Automation can help streamline budgeting, resource allocation, and reporting, making FinOps more efficient and responsive.

- Multi-Cloud Environments: Many financial organizations are adopting multi-cloud strategies to avoid vendor lock-in and enhance resilience. FinOps will play a pivotal role in managing costs across multiple cloud providers, ensuring transparency, control, and cost optimization in complex, hybrid cloud environments.

- Enhanced Cost Visibility: The demand for real-time, granular cost visibility will continue to grow. FinOps tools will evolve to provide more detailed insights into cloud spending, helping organizations make informed decisions about resource allocation and cost reduction strategies.

- Cost Prediction: Anticipating and planning for future cloud costs will become increasingly important. FinOps solutions may incorporate predictive analytics to forecast cloud expenses accurately, allowing organizations to adjust their budgets and strategies proactively.

- Security and Compliance Integration: With data security and regulatory compliance as top priorities in the financial sector, FinOps will integrate tighter security controls and compliance monitoring into its practices. This ensures that cost management aligns seamlessly with risk management and regulatory requirements.

- Cross-functional Collaboration: Collaboration between finance, IT, and operations teams will become more ingrained in organizational culture. FinOps will continue to foster this cross-functional collaboration, creating a shared responsibility for cloud costs and financial accountability.

- Industry-Specific Solutions: FinOps practices will evolve to address industry-specific challenges. Financial institutions will require FinOps solutions tailored to their unique regulatory requirements, data security concerns, and financial intricacies.

In a world where cloud adoption is no longer a question of “if” but “when” and “how,” FinOps will remain the linchpin of financial success in the cloud. It’s not just about cost management; it’s about making strategic, data-driven decisions that ensure financial institutions can thrive in a digital and data-driven future. FinOps will continue to evolve, adapting to the ever-changing landscape of cloud computing while helping organizations navigate it successfully.

Microsoft Azure: Your Partner of Choice

Microsoft Azure, one of the leading cloud service providers, offers a robust ecosystem of tools and services that can be harnessed to implement FinOps practices effectively, particularly in managing data and analytics costs. Here’s how Azure plays a pivotal role in this context:

- Azure Cost Management and Billing: Azure provides its native Azure Cost Management and Billing tool, which is an essential component for any FinOps initiative. This tool offers detailed insights into your cloud spending, allowing you to track, monitor, and optimize your costs in real time. It enables you to set budgets, configure alerts, and gain visibility into cost drivers, empowering you to align your spending with your financial goals.

- Resource Tagging and Cost Allocation: Azure allows you to tag resources, providing granular visibility into which teams or projects are consuming specific cloud services. This tagging capability is instrumental in implementing the accountability principle of FinOps, enabling you to allocate costs accurately to various stakeholders within your organization.

- Azure Cost Explorer: Azure Cost Explorer is a powerful tool that allows you to explore and analyze your historical and forecasted costs. It provides comprehensive cost breakdowns, trend analyses, and forecasting capabilities, facilitating data-driven decision-making for cost optimization.

- Reserved Instances (RIs): Azure offers RIs, which enable you to commit to specific virtual machine configurations for a one- or three-year term. RIs can lead to substantial cost savings, aligning with the optimization principle of FinOps by reducing on-demand spending and providing predictability in cloud costs.

- Azure Advisor: Azure Advisor is an intelligent tool that provides personalized cost-saving recommendations based on your usage patterns and configurations. It helps you identify underutilized resources, resize virtual machines, and optimize your overall cloud infrastructure.

- Azure Policy and Governance: Azure’s policy and governance features allow you to define and enforce compliance rules, ensuring that your cloud resources adhere to your organization’s cost control policies and regulatory requirements. This aligns with the compliance aspect of FinOps, which is crucial in the financial industry.

- Integration with Third-Party FinOps Tools: Azure seamlessly integrates with various third-party FinOps and cloud cost management tools, offering flexibility in choosing the right solution that aligns with your organization’s specific needs and workflows.

- Azure Machine Learning and Analytics: Azure provides a rich suite of machine learning and analytics tools that enable you to derive valuable insights from your financial data. These tools can assist in identifying cost optimization opportunities and making informed decisions to drive cost savings.

In the realm of FinOps, precision is paramount. Financial institutions embarking on their cloud migration journey need a compass that understands the unique demands of their enterprise. Armed with cutting-edge tools, Microsoft Azure serves as that guiding force, ensuring a seamless transition while upholding the pillars of security, compliance, data mastery, and resource optimization. The result? A harmonious and safeguarded shift to the cloud not only upholds operational brilliance but also paints a new landscape of possibilities for the finance industry.

The Data Dynamics Advantage

In pursuit of intelligent data migration to the cloud, Microsoft has partnered with Data Dynamics to introduce the Azure File Migration Program. This collaboration revolutionizes the way banks and financial institutions transition their unstructured files and object storage data to Azure, all while alleviating cost-related concerns. With an automated migration process that prioritizes risk mitigation and maintains control over access and file security, the sanctity of financial data is preserved. And here’s the clincher – these migrations are FREE. Click here to learn more.

The distinctive attributes of Data Dynamics’ platform set it apart. It provides a spectrum of features designed to facilitate intelligent data tiering to Azure. Financial institutions can migrate individual files, folders, shares, or even entire volumes from their on-premises storage to Azure through automated migration methods. Employing policy-based data tiering, institutions can establish rules that automatically relocate data to different storage tiers based on usage patterns. This optimization ensures reduced costs and optimal data placement within the appropriate tier. Data governance, a pivotal concern for the finance sector, is equally addressed by Data Dynamics. The platform enables the implementation of policies that enforce data security measures, including encryption, before storing data in Azure—ensuring full compliance with stringent regulatory requirements.

But this partnership goes beyond data migration. It’s a commitment to invigorating intelligent data management across various environments, including On-Premise, Azure, and Hybrid Cloud. By engaging with the program, financial institutions gain the upper hand in migration projects facilitated by Data Dynamics, ensuring a seamless transition to the Azure platform.

The Azure File Migration Program, born from the collaboration between Microsoft and Data Dynamics, directly addresses the formidable challenges encountered during the intricate cloud migration journey. It tackles issues ranging from cost efficiency and data speed to talent acquisition and risk management. By embracing this program, banks and financial institutions can confidently navigate the intricate nuances of cloud computing, unlocking its transformative potential.

To delve deeper into the capabilities of Data Dynamics and the manner in which our platform seamlessly facilitates zero-cost data migration, efficient data management, and cost optimization within Azure, we invite you to explore our website at www.datadynamicsinc.com/microsoft/ . For inquiries, you can reach out to us at solutions@datdyn.com or connect via phone at (713)-491-4298 or +44-(20)-45520800. Allow us to serve as your trusted partner in your journey toward cloud migration and meticulous data management within the finance sector.